At the Find Group, we aim to provide an online service across the different businesses. Here are the steps we take for each business:

Accounting: Tax Returns

1. 1st week in July you will receive an email and link to our tax checklists. Takes a few minutes to fill them out.

2. We send you a File Invite to upload your documents

3. Once we have received your documents we place you in the queue to complete your return

4. We will email you any enquiries we have related to your return/s

5. We send you the Final Report to view. This is when you let us know if any changes need to be made before we lodge the return.

6. Once the invoice is paid and signatures returned, the return is lodged on your behalf.

Financial Planning: Comprehensive vs Scaled Advice

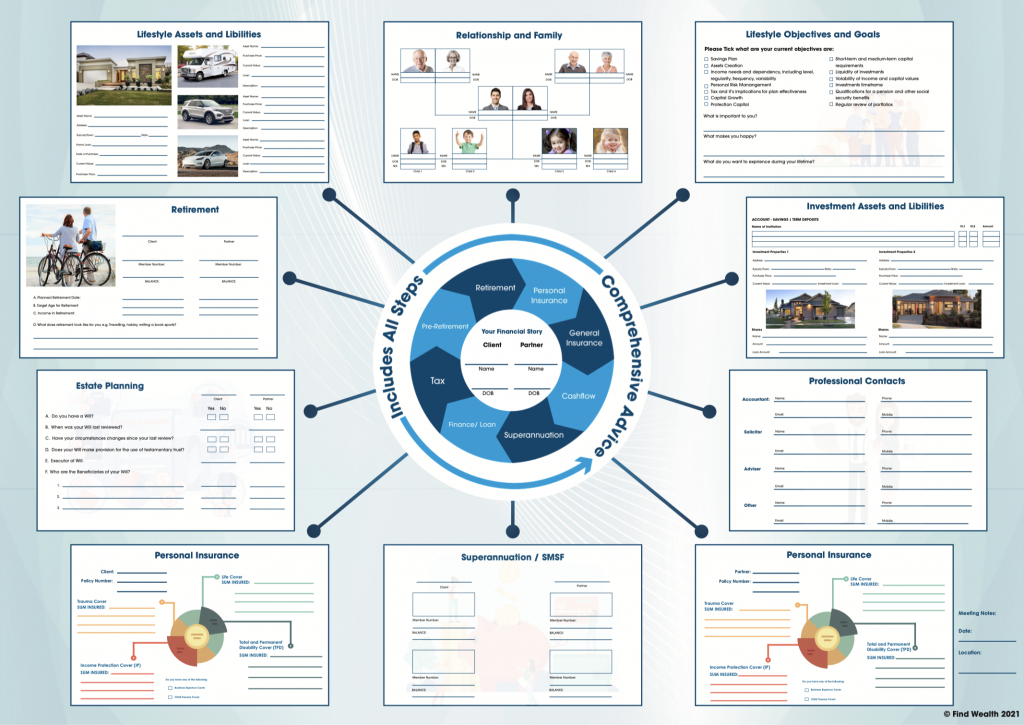

We will take each client through the Find Program. During the Initial Consult, you can elect to receive ‘Scaled advice’ which means you only want us to look at one specific area of your situation right now e.g. Personal Insurances, or you can elect to have ‘Comprehensive advice’, whereby we will review your whole situation. Note: Pre-retirement and Retirement services require comprehensive advice.

If you choose Comprehensive Advice, we will take you through the following steps:

Step 1: Initial Meeting (Phone Call then Face-to-Face)

Before we have a face-to-face meeting, we would like to talk to you to you over the phone and introduce ourselves to each other. Book in a phone meeting (we will call you) to discuss your current situation via our calendar link: https://calendly.com/findgroup/15-minute-phone-conversation.

After the phone call, and if you wish to proceed, we will email you our face-to-face office calendar link so you can come in for the initial meeting. We will take you through our Client World Map (refer below). This will give us a good chance to get to know you and help identify what your current needs are.

Step 2: Further Data Gathering

After the meeting, we will request further document from you:

a) Asset and Liabilities – we will send you a secure link to our wealth portal whereby you can enter in your assets and liabilities.

b) Superannuation/Pension – We will email you a Third Party Authority relating to your superannuation and/or pension accounts.

Step 3: Cash Flow Analysis (if applicable)

Cash flow – don’t worry, we won’t ask you to fill this in. We will send you a secure link via CashDeck requesting up to 12 months worth of transaction history so we can work what your spending your money on and if you have any spare savings capacity. If you don’t want to do this step then we will simply assume that your lifestyle expenses is Income less Tax = Lifestyle Expenses e.g. no savings.

For some of you, you might simply like to fill in an excel with your expenses. We will discuss the best way to gather this information. Keep in mind, that we will need this information if we are do any modelling of current and future scenarios.

Step 4: Insurance Meeting (if applicable)

Insurances (if applicable) – we will ask you to book Phone Call Meeting so we can ask you the questions required of us by law before we can provide a report. Please book in a time via our calendar link: https://calendly.com/findgroup/15-minute-phone-conversation

Step 5: Reports & Fact Find

Prior to our next meeting we will email you the Insurance and Super/Pension Reports & Fact Find. You will need to confirm your information is correct. We will discuss the reports and confirm what services we can provide to you.

Step 6: Meeting & Client Agreement

In this meeting, whether by phone or face-to-face, you will need to confirm what services you require of us, sign an engagement letter, and commit to paying any fees that will be due and payable after this point in time.

Step 7: Risk Profile Analysis

It is a requirement to complete a risk profile assessment when dealing with superannuation/pensions and investments outside of super/pension. We will send you an email and videos to watch which will help guide you through this process.

Step 8: Modelling Scenarios and Meeting (Pre-Retirees & Retirement Clients)

For all Pre-Retirees and those about to Retire, we are required to model your current situation and model alternative scenarios. This modelling will help you decide the path you wish to take. Modelling can answer a lot of questions e.g. will you have enough in retirement or should I sell an investment or not?

During this meeting, you will be presented with the modelling. The modelling will guide you as to which path you might like to take from a monetary perspective however, it will be up to you to decide which path to take.

Step 9: Statement of Advice (SoA) Preparation & Presentation

We will present you with the Statement of Advice related to each area we need to cover. This is where we bring together the products to support your goals and pathway you have selected.

Step 10: Onboarding and Ongoing Reviews

When the SoA has been signed, we will submit any relevant applications and you will elect the type of ongoing services you wish to be provided with.

The following table is indicative pricing e.g. it gives you an idea of the fees we might charge you: